Little Known Questions About Stonewell Bookkeeping.

Table of Contents4 Simple Techniques For Stonewell BookkeepingTop Guidelines Of Stonewell BookkeepingAn Unbiased View of Stonewell BookkeepingTop Guidelines Of Stonewell Bookkeeping4 Easy Facts About Stonewell Bookkeeping Explained

Rather of going via a filing closet of various files, billings, and invoices, you can offer in-depth documents to your accounting professional. After utilizing your audit to file your tax obligations, the IRS might choose to do an audit.

That funding can come in the kind of owner's equity, gives, service lendings, and investors. Investors need to have a great idea of your service prior to spending. If you do not have audit documents, financiers can not establish the success or failing of your firm. They require up-to-date, precise details. And, that info needs to be conveniently obtainable.

Some Known Incorrect Statements About Stonewell Bookkeeping

This is not intended as lawful advice; to learn more, please go here..

We answered, "well, in order to understand just how much you require to be paying, we need to recognize just how much you're making. What are your earnings like? What is your earnings? Are you in any financial debt?" There was a long time out. "Well, I have $179,000 in my account, so I presume my earnings (earnings much less expenditures) is $18K".

5 Simple Techniques For Stonewell Bookkeeping

While it might be that they have $18K in the account (and even that could not hold true), your equilibrium in the financial institution does not always establish your earnings. If someone obtained a give or a lending, those funds are not taken into consideration profits. And they would certainly not work right into your income declaration in identifying your earnings.

Lots of points that you believe are costs and reductions are in truth neither. Accounting is the process of recording, identifying, and arranging a firm's monetary transactions and tax filings.

An effective organization calls for assistance from professionals. With sensible goals and a qualified bookkeeper, you can quickly deal with obstacles and maintain those concerns away. We're below to help. Leichter Bookkeeping Services is a skilled certified public accountant firm with an enthusiasm for accountancy and dedication to our clients - franchise opportunities (https://244636314.hs-sites-na2.com/blog/why-bookkeeping-is-essential-for-your-business-success). We dedicate our power to guaranteeing you have a strong financial foundation for development.

Stonewell Bookkeeping Things To Know Before You Get This

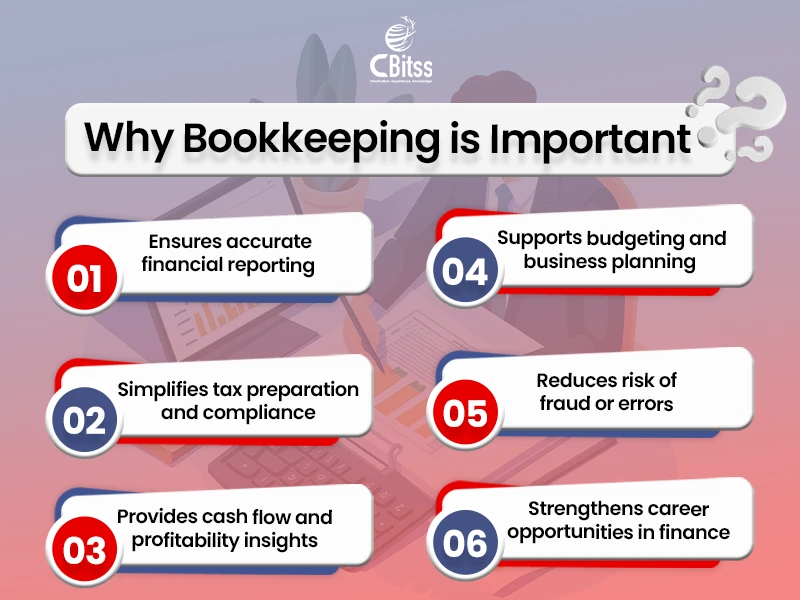

Accurate accounting is the foundation of excellent monetary management in any company. It aids track earnings and costs, ensuring every deal is taped appropriately. With great accounting, businesses can make better decisions because clear financial documents offer beneficial data that can lead technique and boost profits. This details is key for lasting planning and projecting.

Accurate economic declarations build depend on with lenders and capitalists, enhancing your opportunities of getting the capital you need to expand., organizations need to consistently integrate their accounts.

A bookkeeper will certainly cross financial institution statements with inner documents at the very least once a month to find blunders or incongruities. Called financial institution settlement, this process guarantees that the economic documents of the firm suit those of the financial institution.

They check existing payroll data, subtract tax obligations, and figure pay ranges. Bookkeepers generate standard monetary reports, consisting of: Earnings and Loss Declarations Reveals revenue, expenses, and web profit. Equilibrium Sheets Notes properties, obligations, and equity. Money Flow Declarations Tracks cash activity in and out of business (https://www.bark.com/en/us/company/stonewell-bookkeeping/zzNAbd/). These reports help company owner comprehend their monetary placement and make educated decisions.

The 2-Minute Rule for Stonewell Bookkeeping

The best option relies on your budget plan and service requirements. Some local business proprietors choose to handle bookkeeping themselves utilizing software program. While this is cost-efficient, it can be taxing and vulnerable to mistakes. Tools like copyright, Xero, and FreshBooks enable entrepreneur to automate bookkeeping tasks. These programs assist with invoicing, financial institution reconciliation, and financial coverage.